TOGETHER parent, FTX reach tentative settlement

Subject to court approval, deal is latest development in FTX’s attempt to claw back $53.25m in funds from Purpose Life Sciences, the parent company of the TOGETHER trial platform

(Note: All legal filings pertaining to the lawsuit are available here).

At the start of the year, we had reported that the parties in the case involving TOGETHER and FTX would move towards jurisdictional discovery.

It’s now emerged that FTX’s administrators have reached a tentative settlement with Purpose Life Sciences (PLS), the company founded by Edward Mills to operate the TOGETHER trial platform.

The settlement, which is subject to approval by the court, transpired from the following footnote in a Jan. 17 legal filing:

On January 10, 2024, the Plaintiffs reached a settlement in principle with Defendant Platform Life Sciences, Inc. (“PLS”) to resolve Plaintiffs’ claims against PLS. Because that settlement is subject to Bankruptcy Court approval, the Debtors intend promptly to file a Rule 9019 motion seeking approval of the settlement. Plaintiffs and PLS have agreed to hold in abeyance any discovery of PLS pending court approval of the settlement.

The same filing notes that FTX has also amended its original complaint to drop any mention of PLS’s Delaware registration. The new complaint describes PLS as incorporated “in British Columbia, Canada in February 2021“. It used to say: ”incorporated in British Columbia, Canada in February 2021 and in Delaware in March 2022”.

Mills has argued to dismiss the case against PLS on the grounds that it is a Canadian company, and as such not under the jurisdiction of the Delaware court.

The Jan. 17 filing doesn’t disclose the contents of the proposed settlement.

As those who have followed our coverage know, the other five life sciences companies in the suit, along with former head of the FTX Foundation Nicholas Beckstead, have also reached a tentative settlement with FTX. As part of that proposed deal, detailed last November, the defendants agreed to transfer Latona’s rights and interests in those companies to FTX, in exchange for FTX abandoning all other claims against them. These rights would include shares, a convertible note and future royalties.

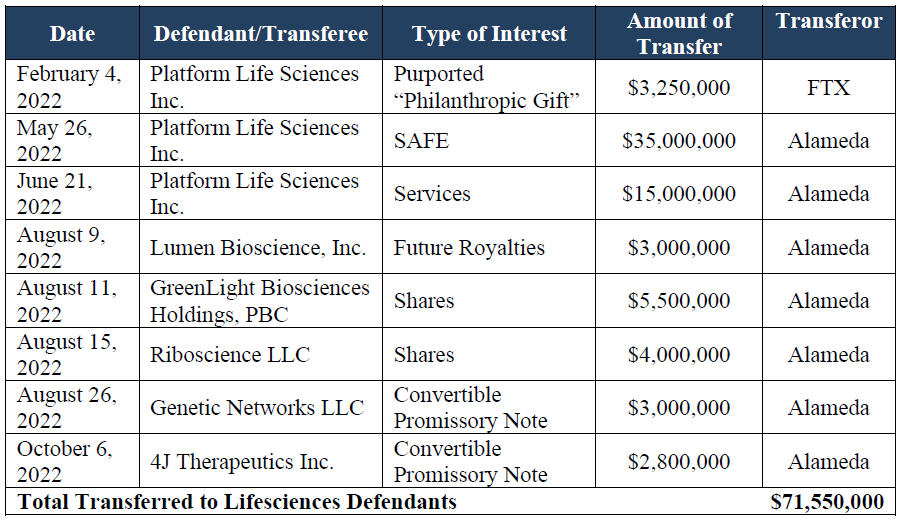

The table below, from the original complaint, shows the details of FTX’s claims against each of the companies.

The court consequently stayed proceedings against Beckstead and the five companies. A sticking point, it seems, could be that as part of the deal Rheingans-Yoo has asked that FTX recognize nearly $1 million in “alleged unpaid salary and bonus”.

We don’t know if a deal between PLS and FTX would take a similar form. Maybe a settlement will take a wholly different form — PLS’s Canada incorporation, and the much larger sum involved in its case than with the other companies, make it a different situation.

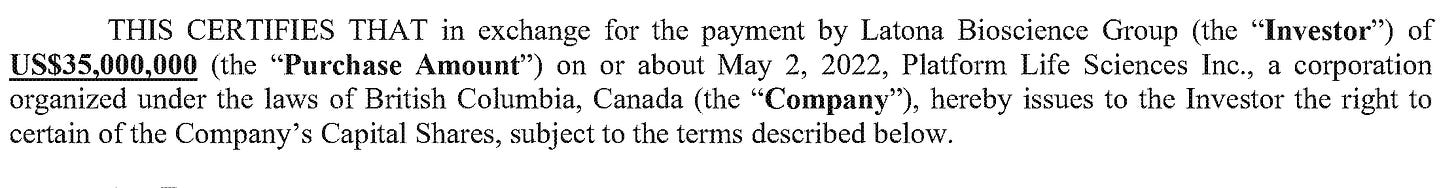

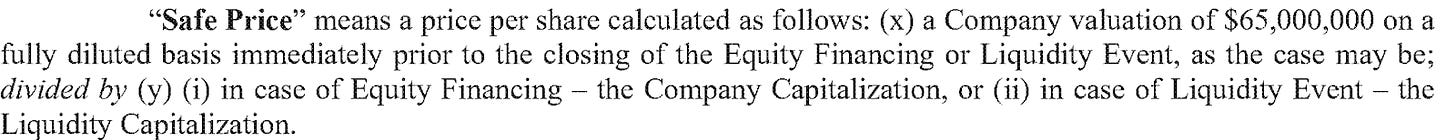

If it were to take a similar shape, it would mean that the SAFE note held by Latona would transfer to FTX. As we revealed in November, the note is a big deal: in the event of any equity financing round or liquidation event, it gives Latona rights to claim at least 53.8%1 of PLS if the company is valued at $65m or above, and more if it’s valued at below that amount. Given that the company has not gained significant revenue since, smart money is on valuation being lower, and therefore the ownership stake that would end up in the hands of FTX in this scenario would be even higher than 53.8%, perhaps substantially so.

Whatever happens, we’ll keep you posted here. In the meantime, the tentative settlements leave Latona Biosciences, Ross Rheingans-Yoo and Samuel Bankman-Fried as the remaining active defendants in the case for now.

Bankman-Fried, who has not yet responded to the complaint, has until Jan. 30 to respond.

See exhibit 57 in Document 42-2 pages 124-131. The SAFE note agreed on a payment of $35m against a company valuation of $65m (“Safe Price”). When converted the $35m would translate to a stake of $35m/($100m-$35m) = 53.8%. Because of the implied valuation cap and the Most Favored Nation clause, Latona is guaranteed at least that size of a stake.

The "Together" trial was set up in an attempt to discredit ivermectin and HCQ, to get more people to submit to the very dangerous and utterly ineffective injection of toxic genetic slime.