TOGETHER Files 2: Lawsuit reveals FTX insider bought effective control of TOGETHER trial, part of SBF's dream of a pharma empire

FTX's legal battle to claw back billions in customer funds has unearthed a surprising finding.

Legal documents reveal that a non-profit controlled by former FTX CEO Sam Bankman Fried and former colleague Ross Rheingans-Yoo, alongside FTX itself, invested a total of $53.25 million in Purpose Life Sciences, the company that owns the TOGETHER trial.

The investments give the non-profit (Latona Biosciences) control over at least 54% of PLS in any future equity or liquidation event.

As far as we can tell, Latona is still active and unaffected by the FTX collapse, begging the question of what this means for the future of PLS and TOGETHER.

FTX’s bankruptcy administrators are suing Latona and PLS to recover the investments, claiming they were fraudulent and using comingled customer funds.

(Nov 9 update: The article forgot to mention that the court agreed on Nov. 1 to temporarily halt legal proceedings against the small life sciences companies and Beckstead. The case against PLS, Rheingans-Yoo, SBF and Latona is still active.)

When we previously covered this topic on this Substack, we had no idea how deep the rabbit hole went. We recently discovered a trove of documents showing FTX's legal battle to claw back billions in customer funds fraudulently spent by founder Sam Bankman-Fried (SBF) and close insiders.

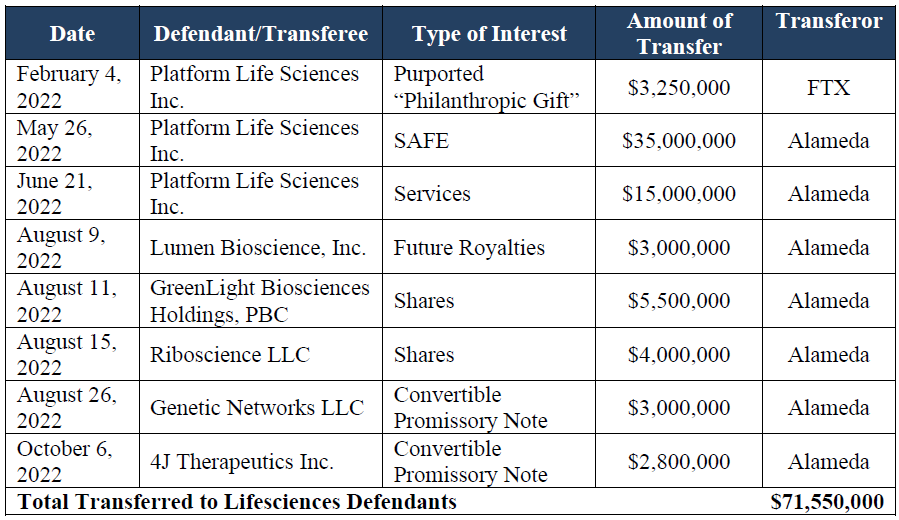

The legal filings (see documents here) reveal that a Bahamian non-profit created by FTX, and run by a former colleague and acquaintance of SBF, owns the rights to potentially control the company behind the TOGETHER trial. The deal was part of $71 million in funds invested in six life sciences companies, allegedly with the aim of secretly enriching SBF, and which the new management of FTX is now trying to reclaim.

Launched in 2020 to investigate early treatments for COVID-19, TOGETHER is an adaptive trial platform that can quickly iterate through clinical trials, with the aim of allowing for concurrent and faster evaluation of medical drugs. It orchestrated the largest study of ivermectin for COVID, and made headlines for finding the drug was not effective in treating COVID. Since 2021 TOGETHER is owned and operated by Purpose Life Sciences (PLS, formerly Platform Life Sciences), a Canadian for-profit startup registered in British Columbia and founded by TOGETHER principal investigator, professor Edward J. Mills.

News has previously surfaced about ties between FTX and TOGETHER. In May 2022, FTX announced $18.25m in “financial support” from its Delaware-registered FTX Foundation to fund TOGETHER’s expansion and “help prevent future pandemics”.

We can now say, however, that was far from the whole story. Filings from a Delaware bankruptcy lawsuit – in which FTX is suing SBF, two key executives and the six life sciences companies in a bid to reclaim the $71m – paint a different picture.

In reality, the FTX Foundation was not involved in the investment. The money came from FTX and its sister company Alameda Research and was made on behalf of Latona Biosciences, a non-profit registered in the Bahamas in June 2022 and run by Ross Rheingans-Yoo, with SBF as the only other director. SBF and Rheingans-Yoo – who is also named as a defendant in the suit – were acquaintances: the pair were former colleagues and had lived together in Hong Kong and the Bahamas, according to the complaint. Crucially, even though Rheingans-Yoo introduced Latona in at least one email as “a member of the FTX Foundation Group of companies”, the non-profit is still active and does not appear affected by the FTX bankruptcy proceedings.

The amount was also off: while FTX had indeed committed to give $18.25m to TOGETHER, the May announcement omitted to say that FTX wired another $35m to PLS that same month, in exchange for a board seat and effective future control of the company. How was this done? The documents show that PLS and Latona signed a modified SAFE note in May 2022. In the event of any equity financing round or liquidation event, the SAFE gives Latona rights to own 53.8%1 of PLS if the company is valued at $65m or above, and more if it’s valued at less. The size of the stake could in theory be even higher regardless of the valuation as the SAFE includes both a valuation cap and a “Most Favored Nation” clause – clauses that are not usually granted together. As part of the agreement, Latona also appointed Rheingans-Yoo to the board of PLS, joining the then only two directors, Mills and then CEO Michael Zimmerman (who has since left).

In all, FTX sent $53.25m to PLS in three transactions that year: a $3.25m grant, received on Feb. 4, the $35m SAFE, received on May 26, and a $15m “cash advance”, received June 26.

Reading through the exhibits and legal complaint, there is a sense of urgency in agreeing on the deals and sending the money over.

According to his own account, Mills was introduced to FTX in January 2022, via “a third party from Ireland”. FTX’s complaint says he pitched an investment to FTX “on or around January 25, 2022”, and Rheingans-Yoo approved the $3.25m grant on January 29. That’s four days from pitch to approval.

The $15m and $35m payments appear similarly hurried. On May 23, Rheingans-Yoo asked for the money to be moved “as soon as possible”, even though no agreement had been signed for the $15m tranche.

On June 1, PLS’s legal team told their counterparts at FTX that “PLS folks are breathing down our neck” to wrap up the agreement for the $15m. Latona had actually already agreed to provide $15m to PLS, and the only thing holding it up was figuring out what form the funds would take. In the end, while presented as a service agreement, no services were ever specified for it.

“We understand that Platform would also like an additional $15M cash advance for future trials,” FTX’s then general counsel Can Sun wrote in an email to PLS’s lawyers on April 28. “Any thoughts on how best to structure this? We’re thinking of a simple loan with 2 year maturity and negligible interest (whatever the minimum AFR required by the CRA) but open to other thoughts as well.” The parties later agreed on “papering” it as a “cash advance” for services that were never specified.

“We understand that Platform would also like an additional $15M cash advance for future trials. Any thoughts on how best to structure this?” - FTX counsel

PLS’s business model consists of charging for clinical trials, and the investment pitch from Mills to FTX in early 2022 shows they planned to offer three packages: bronze, silver and gold, for $10.4m, $16.9m and $35.75m respectively. As far as we can tell, the only commercial partner that TOGETHER has signed on is Eiger Biopharmaceuticals, which commissioned the study into Peginterferon Lambda in 2021. All other funding has been from charities. The Gates Foundation funded the hydroxychloroquine study in 2020, and Fast Grants & Rainwater Charitable Foundation sponsored the ivermectin, fluvoxamine and metformin studies in 2021.

Concealing role of Latona “in case it makes a lot of money”

The revelations about FTX’s investments in PLS contradict the account that Mills gave when approached by Reuters. In November 2022, the news agency questioned Mills about PLS’s $18.25m funding from FTX. Specifically, it wanted to know if the investments could have had any bearing on TOGETHER’s work on ivermectin. In a statement to Reuters, Mills assured it that the funding had no influence on the ivermectin evaluation, stating that “no funding was received (from FTX) prior to May 2022.”

At the time, some questioned the veracity of this account. We now know that that is not true, since the first donation was wired in February. While the ivermectin trial itself was completed in August 2021, the study was not published until the end of March 2022.

Mills in his statement further omitted to mention the additional $35m funding, not to mention the board seat and promise of a controlling stake. He also didn’t clarify that the funding was in the name of Latona, and not the FTX Foundation.

Even to the journal publications, Latona’s name was not completely disclosed. In TOGETHER’s fluvoxamine and budesonide studies, published in May 2023, the authors name “Latona Foundation” as a sponsor – a mashup of “FTX Foundation” and “Latona Biosciences”.

In so doing, Mills was — wittingly or not — doing the bidding of SBF and his close circle. In an email to Mills, Rheingans-Yoo wrote, according to the complaint: “In general, our [Latona’s] participation should be described as ‘FTX Foundation’ in all public-facing communication” and “we’d prefer not to mention the discussion terms of the equity stake at this point, to avoid pulling the public narrative to speculation about profit motive.”

Latona’s “participation should be described as ‘FTX Foundation’ in all public-facing communication… we’d prefer not to mention the discussion terms of the equity stake at this point, to avoid pulling the public narrative to speculation about profit motive” – Rheingans-Yoo

Why was Latona’s participation concealed? According to the complaint, SBF, Rheingans-Yoo and Nicholas Beckstead, then head of the FTX Foundation and also listed as a defendant, discussed hiding the role of Latona in the investments to the life sciences companies, in case it would make “a lot of money”.

Despite Latona’s incorporation as a non-profit company, Rheingans-Yoo hoped that Latona would “make[ ] a ton of money.

A PR project

According to the legal complaint, SBF conceived of Latona in January 2022, as an “FTX Foundation Project” that would devote hundreds of millions of dollars towards supporting promising new drugs transition from ideas to reality. The motivation, it seems, was partly for his own personal capital: “for PR and political reasons it’s really important to do bio things, and to do some public/networky bio things,” SBF wrote in an internal document.

PLS was the first of these investments, followed by Lumen Bioscience, GreenLight Biosciences, Genetic Networks, and two companies founded by Jeff Glenn, Riboscience and 4J Therapeutics. Glenn’s Stanford lab The Glenn Lab also received a $4m grant but is not listed as a defendant. No reason is stated for this; in September Stanford announced it would return $5.5m in donations from FTX, perhaps those funds are included in that sum.

“for PR and political reasons it’s really important to do bio things, and to do some public/networky bio things” - SBF

In the complaint, the plaintiffs paint a picture of investments done far above fair value, with no or minimal due diligence, and in a “slapdash fashion”.

The complaint suggests that Mills is the one who introduced SBF to several of those companies, with emails showing he connected them to Glenn and Lumen: “Rheingans-Yoo acknowledged that the fact that numerous investment opportunities ‘have come from Ed Mill’s [sic] network . . . substantially increase[s] the chance that they all suck.’”

Glenn had previously worked as co-principal investigator for TOGETHER, as part of Eiger Pharmaceuticals’ commission of a study to investigate lambda-interferon for early COVID treatment.

The connection with Greenlight is described by Beckstead as a “random CEO pitching this to Ross [Rheingans-Yoo] at a conference”, according to the complaint. However, both Greenlight and PLS share an executive in Mark Dybul. Dybul, who was a research fellow at NIAID under Anthony Fauci, has held numerous prominent positions and was appointed as Ambassador by George W. Bush to be the United States Global AIDS Coordinator, is on the board of Greenlight since 2020, and joined PLS as executive chairperson in October 2022. In February, Greenlight and PLS received approval to run a trial for a universal COVID-19 mRNA vaccine in Rwanda. A look at Clinical Trials suggests that the trial was withdrawn in August, citing intent “to prioritize other programs” as the reason.

The reason might be financial – in May 2023, Greenlight was taken private by the private equity Fall Line Capital, in a deal that valued the company at 3 cents per share. That was less than 1/10th the value at which FTX had invested in Greenlight in August 2022.

The revelations raise many questions which we don’t know the answer to. Was SBF’s investments in the life sciences companies a mere ploy for personal aggrandizement and enrichment by Sam Bankman-Fried and his close colleagues, as alleged in the legal filing? Why did they specifically choose TOGETHER, and what does Latona’s involvement mean for the future of PLS, and the TOGETHER trial?

We don’t have answers to these questions. What we can say is these are not the first concerns to arise about TOGETHER.

TOGETHER and ivermectin: Glaring issues give pause about results

For the uninitiated, let’s rewind. In 2020 Mills launched TOGETHER, the largest set of trials ever done to investigate repurposed generics including ivermectin for treating COVID-19. In 2022, its findings were seized upon by media reports as the final nail in the coffin of ivermectin for the treatment of COVID. Six months before it even published its results, the BBC used it to conclusively declare ivermectin inefficient against COVID, in an article that won a prize for exposing false information. Ivermectin had until then been considered a cheap ‘wonder drug’, with a long history of usage across the world and excellent safety profile.

TOGETHER is the property of PLS, a for-profit Canadian startup led by Mills as founder and Chief Science Officer, and as CEO since at least May 2023.

While TOGETHER won accolades for its work, close examinations of its published data have highlighted a string of ethical and numerical issues with the trial, casting doubts on its published conclusions. IVM Meta has summarized the problems here, listing 36 critical issues, as well as 23 serious and 20 major ones. An article by the Cato Institute went through several of those issues, and recomputed the probability that ivermectin did help patients in the TOGETHER trial. “Based on our results, it is difficult to agree with the conclusion that the TOGETHER trial showed ‘no sign of any benefit’ for ivermectin,” the authors wrote. Instead, “there is still good reason to continue studying the drug as a possible preventative or treatment for COVID-19.”

“Based on our results, it is difficult to agree with the conclusion that the TOGETHER trial showed ‘no sign of any benefit’ for ivermectin” - Cato Institute

As reported on this Substack, leaked documents have revealed further concerns, showing that the trial authors violated the blinding and modified the enrolment protocol during the trial in a way that would have skewed the results against ivermectin.

The trial has also failed to live up to its transparency pledge. Mills and the study authors to date have failed to release the trial’s data, despite the authors’ pledge to make it available to all “immediately after publication”. TOGETHER hasn’t shared the data with Cochrane itself for its meta-analysis of ivermectin studies, and we know from sources it has refused to share it with the Rainwater Charitable Foundation, even when pressed for it. Meanwhile, the organization that was supposedly in charge of keeping the data, the International COVID-19 Data Alliance, said it did not have the data.

TOGETHER similarly never filed a preprint for its ivermectin study, even though it’s one only four conditions Fast Grants lists in its terms: “You must upload all manuscripts reporting work supported by the grant to a preprint server [...] upon submission to a peer-reviewed journal”. As a result, we still don’t know when the initial paper was submitted to the journal, and what the first version looked like.

There is a “clear signal that IVM works in COVID patients” – Edward Mills

The issues with blinding and data make the lack of transparency more salient. It doesn’t help that Mills himself has spoken from both sides of his mouth when it comes to the efficacy of ivermectin. There is a “clear signal that IVM works in COVID patients”, he wrote in an email to Marc Rendell on April 3 2022. Yet only days before, he had told the Wall Street Journal that “There was no indication that ivermectin is clinically useful” against COVID. Philip Harper has cataloged other examples of this here.

Add to this the responses from Mills in leaked private messages. By many metrics, Mills is a highly successful scientist: a health sciences professor at Canada’s McMaster University, he has at least one award and hundreds of papers to his name, and was the driving force behind TOGETHER. As described by this Cytel executive here, Mills “conceptualized” the trial, and was its public face to media and regulators.

Yet, responding to a Canadian pastor who was following the trials, Mills signed his emails with “Glory to Satan”, “Fuck off. Pray to your stupid god for insights”, and also “You are one of these fuckers Pastor. You are a disgusting human being. Should I tell your congregation? You fucking asshole.” In another email thread with a Brazilian researcher enquiring about the trial protocol, he resorted to accusing him of being a Megele admirer, and telling him to “Fuck off”. For a detailed account with receipts, we’ll refer you to this piece by Pierre Kory.

“Fuck off. Pray to your stupid god for insights” – Mills, responding to a pastor enquiring about ivermectin trial

Where does this all leave us? We have a large, well connected platform with a novel and ingenious technology promising to allow for fast iteration of clinical trials. Its research influenced key treatment decisions for COVID-19 for repurposed generics like ivermectin. Yet the same platform failed to release its data, and appears to have several ethical and numerical issues that throw shade on its own conclusion about ivermectin.

Now it turns out the platform’s architect is one of the many victims of SBF’s financing web, and the platform’s future is joined at the hip to a close associate of SBF. In his legal response to FTX’s attempt to reclaim the funds invested in the name of Latona, Mills has argued to dismiss the case based on the grounds of foreign jurisdiction, considering PLS is registered in Canada. A response from Rheingans-Yoo informs that he has hired counsel for the case.

The lawyers representing FTX in the case declined to comment. Requests for comment to Mills, PLS, Fast Grants and Rainwater Charitable Foundation went unanswered.

See exhibit 57 in Document 42-2 pages 124-131. The SAFE note agreed on a payment of $35m against a company valuation of $65m (“Safe Price”). When converted the $35m would translate to a stake of $35m/($100m-$35m) = 53.8%. Because of the implied valuation cap and the Most Favored Nation clause, Latona is guaranteed at least that size of a stake.

Thanks for this very interesting research!

Any chance that the lawsuit with force disclosure of the data?