Court denies Mills's motion to dismiss FTX vs TOGETHER lawsuit

Parties will proceed to jurisdictional discovery, meaning both sides will seek evidence to prove whether or not the suit against TOGETHER's parent company can be tried in the US

The US Bankruptcy Court for Delaware has denied a motion to dismiss FTX’s lawsuit against Purpose Life Sciences (PLS, formerly Platform Life Sciences) based on lack of jurisdiction. PLS is the commercial entity that owns and operates the TOGETHER trial platform.

In a Jan. 3 ruling, judge John T. Dorsey ordered that plaintiffs and defendants can now proceed to jurisdictional discovery in the case. In other words, both sides may now gather information to support or oppose the claim of jurisdiction. Following this process, PLS will be allowed to renew its motion to dismiss.

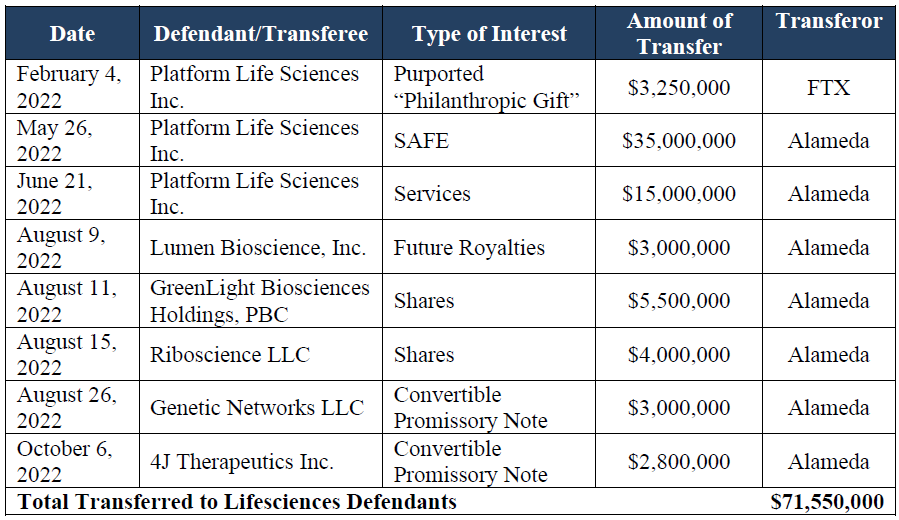

As you may recall, FTX’s administrators is suing PLS along with Sam Bankman-Fried, associates and five other life sciences companies, in an attempt to claw back funds totaling $71.55 million wired from FTX and its sister company Alameda. The lion share of those funds, $53.25m, went to PLS.

In September, PLS founder and CEO Professor Edward J Mills filed a motion to dismiss, arguing that the court had no authority over PLS, which is a Canadian entity. It is this motion that the judge has dismissed.

Readers of this Substack will undoubtedly remember that Mills, who is himself Canadian, is the principal investigator of the TOGETHER trial.

The funds which FTX’s administrators are trying to reclaim were wired from FTX and its sister company Alameda in 2022. The laregest of the transactions were directed by Latona Biosciences, a Bahamian non-profit created by Bankman-Fried and led by his former colleague (and former housemate in Hong Kong) Ross Rheingans-Yoo. FTX’s administrators argue that the transactions were fraudulent, in part as the money came from comingled FTX customer funds. As we reported last fall, the lawsuit revealed that the investments gave Latona the rights to at least 53.8% of PLS in the event of any equity financing round or liquidation event.

Between a rock and a hard place

In his motion, Mills had laid out detailed arguments for why the court had no jurisdiction in the matter. FTX’s lawyers retorted with multiple exhibits1 detailing the extent of PLS’s activities in the US, including reels of LinkedIn profiles of all its key executives (all US based).

Lo and behold, as we reported, PLS has since seemingly scrubbed all US-based senior executives from its website (except for its chairman).

Whether or not the lawsuit does proceed, the stakes appear high for PLS and TOGETHER.

Even if the suit is dismissed, and PLS gets to keep the funds, the SAFE note between Latona and PLS remains valid. Which means that if ever PLS tries to raise more funds, Latona will automatically be granted more than 54% (53.8% to be precise) of the company — a fact liable to deter potential investors.

Maybe that won’t be a problem. Though as far as we can tell, PLS hasn’t had any other revenue or funding since the $53.25m which it received from Latona. Any funding or new revenue source would likely have materialized in planned clinical trials, but none have been announced, or registered. We could not find any sign of a commercial partner besides Eiger Biopharmaceuticals, which in 2021 commissioned the study into Peginterferon Lambda. That trial ended on Feb 7 2022. See more on this here.

If the suit does proceed, maybe PLS will go the way of the five other bioscience companies named as defendants in the suit. In October, those five — Lumen Bioscience, GreenLight Biosciences, Genetic Networks, and two companies founded by Jeff Glenn, Riboscience and 4J Therapeutics — along with former head of the FTX Foundation Nicholas Beckstead, entered a proposed settlement with FTX. As part of the proposed deal, the companies have agreed to transfer Latona’s rights and interests in those companies to FTX, in exchange for FTX abandoning all other claims against them. These would include shares, a convertible note and future royalties (see the table below).

It’s unclear whether such a settlement would be offered to PLS, considering the investment in PLS is far bigger than those in the other five. If it does, it means that the investment that Latona owns in PLS would be transferred to FTX.

However the other possible result, and more likely, is that PLS will be required to return the funds, at least a portion, that it got from the investment. The $53.25m PLS has received from Latona since January 2022 was supposed to take it a long way. In PLS’s budget, shared in its pitch to FTX (see exhibit 1), it was quoting quarterly costs of just above $800K in Q2 2022, with plans to ramp up to up to $10m a quarter by the end of 2023. Given that the ramp-up didn’t go as planned, it is plausible that PLS has a substantial amount in the bank.

If PLS is forced to return the entire amount, given that it is extremely unlikely that PLS has the whole amount on hand, they would have to liquidate themselves and give all the proceeds to the FTX administrators.

Discovery proceedings

For the rest of us, the people following TOGETHER and the trial, the jurisdictional discovery proceedings might also be important. Maybe we can find out more information about how the FTX deal happened, who made the original introduction, what was SBF’s reasoning, and more.

We will keep following this case and let you know what happens next.

Wow, just absolutely blown away by how deep this story goes and how absolutely naive I was as to how these studies/companies who conduct them are funded😧

Wasn't FTX also the recipient of siphoned-off taxpayer money to Ukraine? We need Catherine Austin Fitts to follow the money here. Did someone bribe Mills to fake the IVM trial with this money?