TOGETHER Files 2 extra: What does the FTX lawsuit tell us about the future of TOGETHER?

Amid litigation by FTX, a note on TOGETHER's revenue streams and executive team changes.

(Note: All legal documents mentioned in the article are accessible here).

On Monday we published a piece showing how a charity using FTX funds effectively owns the rights to a large chunk of equity in the commercial company behind the TOGETHER trial.

The revelation begs the question of what the future holds for TOGETHER.

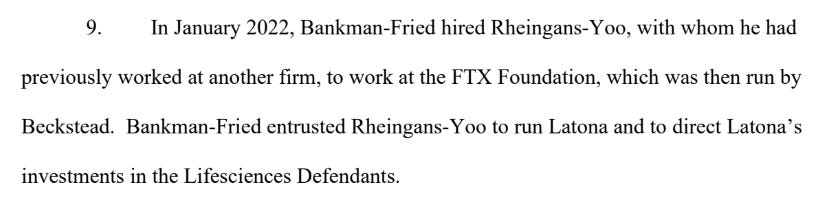

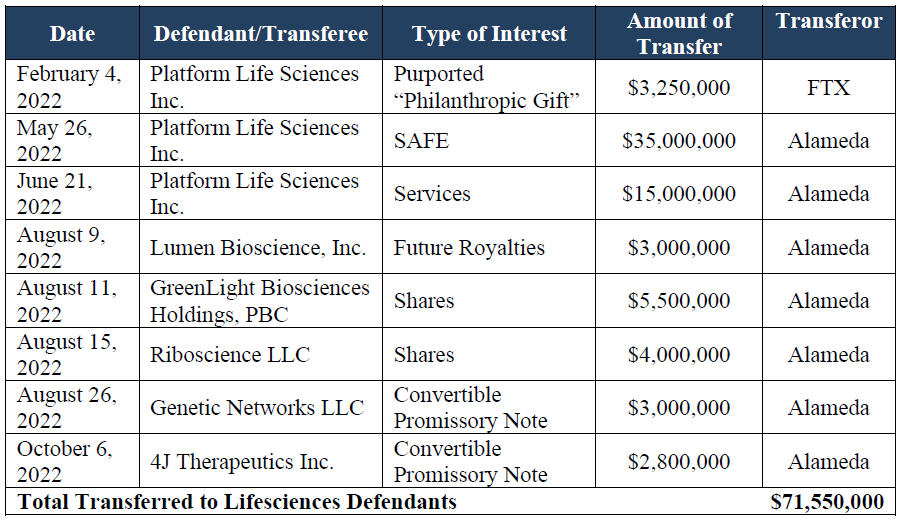

Since the money invested by the charity (Latona Bioscience, registered in the Bahamas) came directly from FTX and its sister company Alameda, FTX’s new management is suing to claw back the $71.5 million that Latona invested in six life sciences companies. Of that amount, the lion’s share ($53.25m) went to Purpose Life Sciences (formerly Platform Life Sciences), the company that owns and operates TOGETHER.

What is Latona?

The charity was incorporated on May 9 2022 and was created by Sam Bankman-Fried, who then hired a former colleague (and former housemate in Hong Kong) Ross Rheingans-Yoo to lead it, according to the complaint.

An SEC filing from GreenLight BioSciences, in which Latona invested $5.5m in August 2022, lists Bankman-Fried and Rheingans-Yoo as the sole directors of Latona, alongside Valdez Russell, a Bahamian and former communications VP at FTX Digital Markets.

Rheingans-Yoo, Bankman-Fried, Latona and the life sciences companies are listed as defendants in the suit, along with former FTX Foundation director Nicholas Beckstead.

Latona is, as far as we can tell, still active. While the funds that Latona invested came directly from FTX, Latona was a separate entity and therefore not included in the crypto-exchange’s bankruptcy proceedings. A case filing dated Oct. 31 further shows that Rheingans-Yoo and Latona have retained counsel and deny all allegations from the FTX complaint. (Note: I haven’t been able to perform a search on the Bahamas company registry, it keeps throwing errors. If anyone is able to successfully do a search, let me know what comes up! Name: Latona Bioscience Group, Type: Non-profit Organization, ID: 1116).

Smaller life science companies, Beckstead tentatively settle

Even while denying all allegations, Latona and Rheingans-Yoo have entered an agreement with FTX, Beckstead and the smaller life sciences companies (i.e. all except PLS) to transfer Latona’s rights and interests in those companies to FTX, in exchange for FTX abandoning all other claims against them. These would include shares, a convertible note and future royalties (see the table below).

As a result the court has temporarily halted proceedings against Beckstead and the five companies. A sticking point could be that the agreement hinges on a condition that FTX recognizes a claim of $993,611.08 in alleged unpaid salary and bonus for Rheingans-Yoo — a claim that FTX denies.

What about PLS?

The stipulation detailing the agreement does not say why PLS did not take part in the deal, but one can think of a few reasons. Unlike the other companies, which are all US-based, Mills is seeking to dismiss the case against PLS as it is based in Canada. Also with PLS the sums at stake are far larger ($53.25m compared to $17.75m to the five other companies).

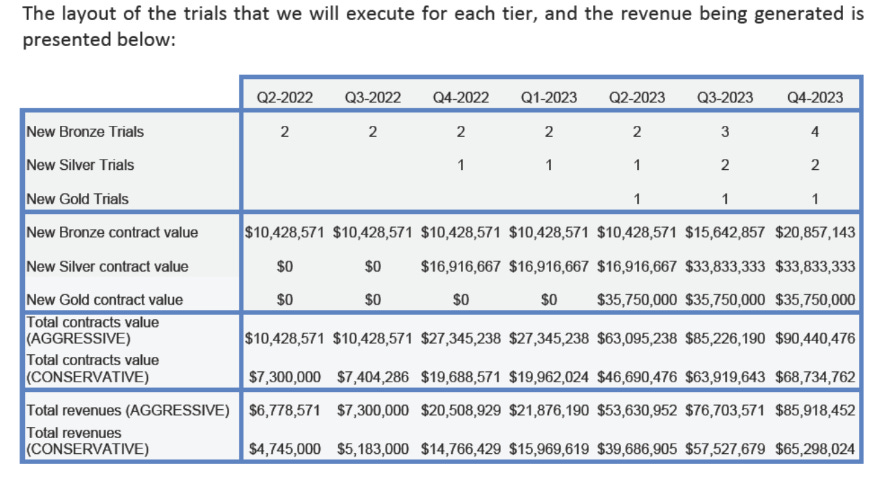

Should FTX succeed in reclaiming all or part of the $53.25m, what does this mean for the future of PLS and TOGETHER? From what we can tell, PLS hasn’t had any other revenue or funding since the Latona investments. In its investment pitch to FTX, PLS laid out its business model as charging for clinical trials, showing they planned to offer three packages: bronze, silver and gold, for $10.4m, $16.9m and $35.75m respectively.

However, there’s no sign of a commercial partner besides Eiger Biopharmaceuticals, which in 2021 commissioned the study into Peginterferon Lambda. That trial ended on Feb 7 2022 (see table below).

The only other commercial trial (i.e. excluding the ones funded by grants) on the cards was one announced with GreenLight Biosciences in February 2023, to study a universal COVID-19 mRNA vaccine in Rwanda. However, that study was shelved in August, before it even started.

Conversely, what if FTX is not successful in reclaiming the funds? If so, PLS gets to keep the funds, but the SAFE note between Latona and PLS presumably remains active. If PLS tries to raise more funds, Latona will automatically be granted more than 54% (53.8% to be precise) of the company — a fact liable to deter potential investors.

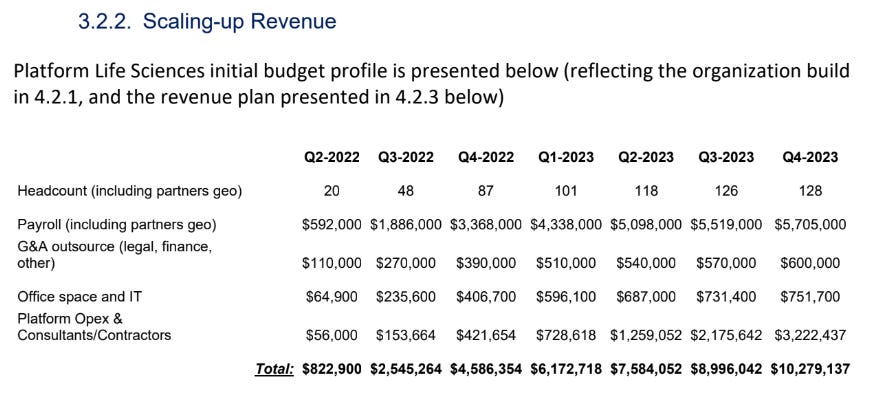

That said, the $53.25m PLS has received from Latona since January 2022 should take it a long way. In PLS’s budget, shared in its pitch to FTX (see exhibit 1), it was quoting quarterly costs of just above $800K in Q2 2022, with plans to ramp up to up to $10m a quarter by the end of 2023.

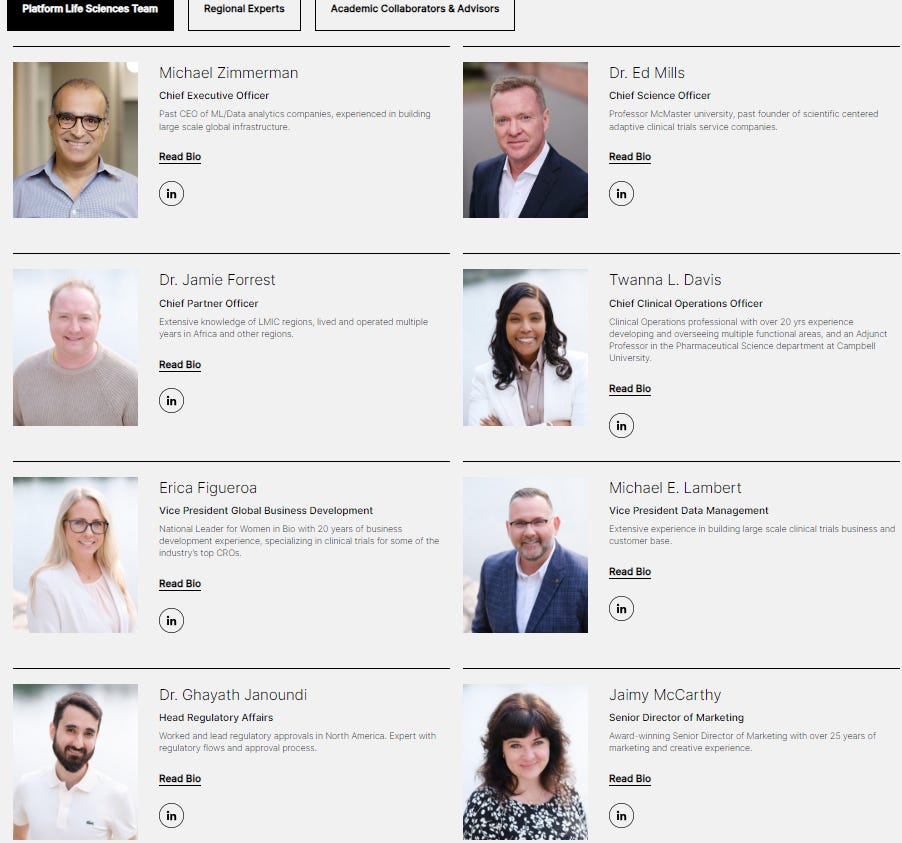

How much of that actually happened, we don’t know. In the communications with FTX in early 2022, PLS says the funding was needed for operational expenses, and it did bring on new staff such as Michael Zimmerman as CEO in February 2022. A Silicon Valley veteran with a solid resume, Zimmerman would not have been a cheap hire, and very likely was brought on board thanks to the fresh $3.25m grant from Latona that month.

However, considering that TOGETHER has only carried out one trial — for fluvoxamine & inhaled budesonide — since receiving the funds, and no new trial is listed on PLS’s website, it’s plausible to think it didn’t scale up to anywhere near those numbers, leaving it quite a runway.

Team changes

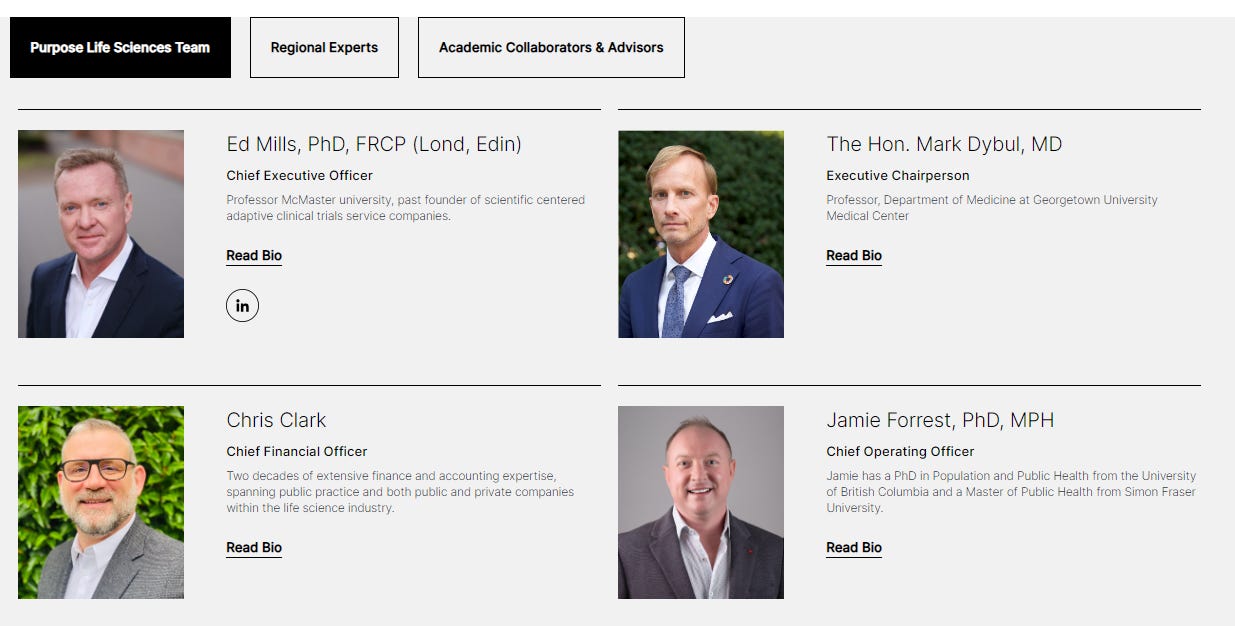

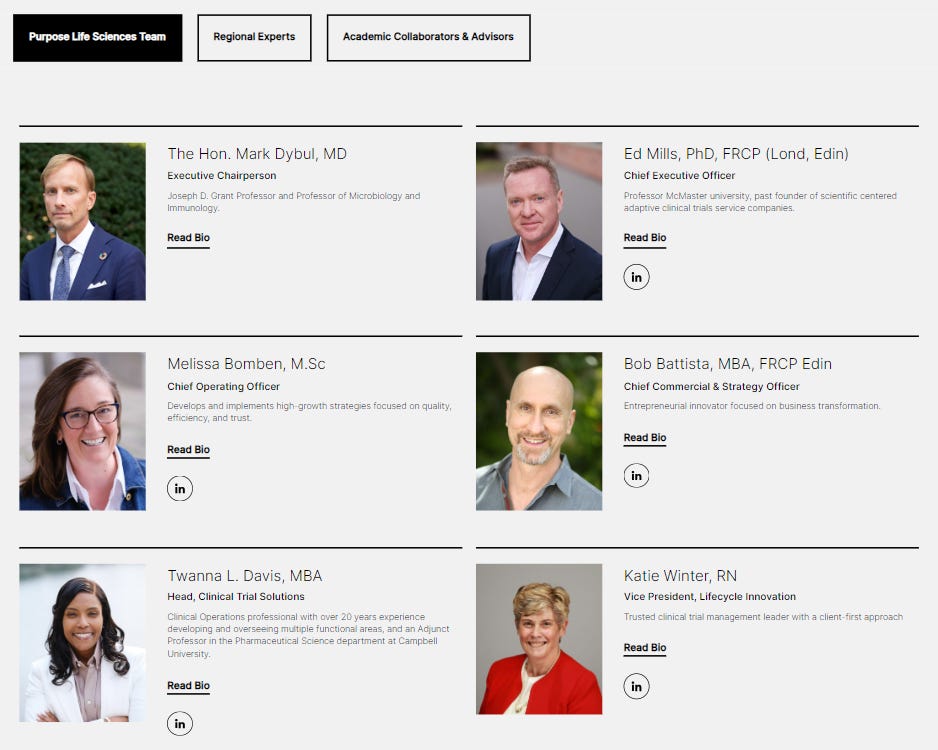

One thing to note here is that PLS’s team page has seen a lot of changes over the past year. Zimmerman, who as mentioned above had been brought on as CEO in February 2022, left sometime in the summer (though he is still listed as executive advisor on LinkedIn). This was after having been demoted to CTO sometime between March 2023 and May 2023, with Mills taking over as CEO.

In all, of 121 key members listed at various points on PLS’s website between November 2022 and August 2023 (the only period for which Internet Archive screenshots are available), only two are still on the website, in addition to Mills and a new CFO Chris Clark (who appeared sometime since October 20232). The two are Jamie Forrest, who has worked with Mills since 2018, and Mark Dybul.

Of the remaining 10, six have left the company, three are no longer on the website but appear to work at PLS still according to their LinkedIn profiles, and the last is Zimmerman.

Interestingly, the four members currently listed are all Canada-based, with the exception of Dybul. I say “interestingly” because in its opposition to dismiss the case on grounds of foreign jurisdiction, FTX’s legal team argued that while registered in Canada, most of PLS’s executive team is US-based.

The motion was accompanied by nearly 400 pages of exhibits (here and here), including screenshots of PLS team members and their LinkedIn pages.

Maybe it is no coincidence then that the three team members that have been stripped from the website but still appear to work at PLS are all US-based. They are Chief Commercial & Strategy Officer Bob Battista, Head of Clinical Trial Solutions Twanna L. Davis and VP of Lifecycle Innovations Katie Winter. When I called PLS’s Vancouver offices to reach Mills for comment on Oct. 4, I was advised to email Battista. On Nov. 9, when I called again, the person who answered the phone confirmed that Battista was still with the company, working from the US. Battista, who joined PLS in the spring, didn’t respond to my email.

The six that have departed PLS include Melissa Bomben, whose hiring the company had announced with a press release in May. Bomben’s LinkedIn doesn’t mention ever working at PLS, but she was listed on the website in May and as late as August 2023, according to Internet Archive screenshots. If my memory serves, Bomben was still listed on the website in early October. If so it means that sometime in the past month, Bomben was removed and replaced with Forrest, who had previously been with PLS as Chief Partner Officer, now as COO.

Forrest is the only of the 12 executives to have been with PLS since its incorporation in February 2021. All the others were hired in 2022 and 2023. According to LinkedIn, Forrest started working with Mills in 2018 at MTEK, a Canadian company which Mills had co-founded with Kristian Thorlund the previous year. MTEK was acquired by Cytel in 2019, and on LinkedIn both Mills and Forrest show they worked at Cytel until 2022. Cytel has been credited as the company which developed the software used by TOGETHER. For more on the background story of MTEK and Cytel, see this piece from last year.

Dybul appears to have joined PLS in October 2022, two months after Greenlight Biosciences — where he sits on the board — received $5.5m from Latona. Dybul’s the only executive we could find to be active at two of the companies that Latona invested in.

With his own Wikipedia page, Dybul is no small fry. He was a research fellow at NIAID under Anthony Fauci, has held numerous prominent positions and was appointed as Ambassador by George W. Bush to be the United States Global AIDS Coordinator.

Dybul is also CEO of Renovaro Biosciences, the company known as Enochian BioSciences until it changed its name in August 2023. Enochian3 had been mired in scandal after its co-founder, chief scientist and majority shareholder Serhat Gumrukcu was arrested over murder-for-hire charges in May 2022 over the killing of a former business associate. The rabbit hole on Gumrukcu and Enochian goes deep, involving not just murder but also scientific and financial fraud.

In October 2022, Enochian sued Gumrukcu and his husband, alleging that it paid them $25 million based on scientific data that Gumrukcu altered and fabricated. Yet there were people calling foul long before the news broke out. See this deep dive from 2019 by Seeking Alpha, linking to a report in which it called Enochian “a house of cards”, warning that Gumrukcu was not a doctor, and his purported scientific achievements were a hall of mirrors.

In a June 2022 in-depth piece on Gumrukcu, Enochian’s former CEO Dr Eric Leire alleged to the WSJ that the board fired him in 2019 after he had raised his concerns about Gumrukcu to the board. Commenting to the WSJ at the time, Dybul denied that Dr Leire shared his doubts with the board. Enochian subsequently sued Leire for defamation over his statement, arguing Leire “praised and promoted Gumrukcu’s ideas and development efforts” during his time at the company. Leire never filed a response and the parties settled in January.

We’ll stop here, as this is a big enough parentheses as it is. For our purposes, our takeaway is: The only executives who are still listed on PLS’s website are 1) Jamie Forrest, who has worked with Mills in some capacity since 2018, and 2), Mark Dybul, who leads a company mired in a Hollywood-worthy scandal involving scientific fraud.

Mark Dybul, Jamie Forrest, Mark Zimmerman, Twanna L Davis, Michael Lambert, Eric Figueroa, Ghayath Janoundi, Jaimy McCarthy, Melissa Bomben, Aranka Anema, Bob Battista & Katie Winter

Exact date unknown. Clark’s LinkedIn profile doesn’t have any details of his role at PLS, and he was not listed on the team page in August, the most recent Internet Archive screenshot available.