TOGETHER parent agrees to return $16m to FTX

Also, Gilmar Reis and Ed Mills's Purpose Life Sciences are working on a new trial in Brazil to investigate metformin & fluvoxamine for long COVID: REVIVE-TOGETHER

(All legal filings pertaining to the lawsuit are available here).

We now know the details of the proposed settlement between FTX and Purpose Life Sciences, the Canadian company founded by Edward Mills which owns and operates the TOGETHER trial platform.

A motion submitted to the US Bankruptcy Court for Delaware on Jan. 26 shows PLS has agreed to return $16 million in cash to FTX to settle the latter’s lawsuit against it.

We previously reported that FTX and PLS had reached a proposed settlement, but its contents had not been disclosed.

The settlement is subject to court approval with a hearing scheduled for 2/24 and objections due by 2/9.

Two-thirds of PLS’s cash

The $16m agreed on is less than a third of the $53.25m that PLS received from FTX and its sister company Alameda in 2022, and which the plaintiffs had sued to recover.

According to the motion, the sum represents two-thirds of PLS’s available cash, implying that PLS holds $24m. This would mean that PLS has spent nearly $30m of the funds it received:

Resolution of the Plaintiffs’ claims against PLS Canada through the Stipulation is in the best interests of the Plaintiffs and their estates because it will result in PLS Canada promptly returning $16,000,000—representing two thirds of PLS Canada’s remaining cash—to Plaintiffs’ estates.

In the motion, the plaintiffs note that the settlement does not imply any judgement on the merit of their case against PLS. Rather, they say, the amount is more than they believe they can recover through ongoing litigation:

The return exceeds that which Plaintiffs would likely obtain in litigation given PLS Canada’s representations about (i) its limited remaining funds and inability to raise additional funds, (ii) the substantial drain on PLS Canada’s resources that would result from further litigation, and (iii) the cost of PLS Canada’s ongoing clinical trials that would proceed in parallel with this litigation.

This paragraph raises two interesting points.

‘Inability to raise funds’

First is the mention about PLS’s inability to raise additional funds. No explanation is offered here, so we are left to speculate. Is this a reference to the implications of the SAFE note with Latona Biosciences? Or something else?

Let’s backtrack. According to FTX’s legal complaint, the funds received by PLS had been directed by and for the profit of Latona Biosciences, a Bahamian non-profit created by former FTX CEO Sam Bankman-Fried (SBF) and and led by his former colleague (and former housemate in Hong Kong) Ross Rheingans-Yoo. The largest chunk consisted of $35m awarded as part of a SAFE note between Latona and PLS.

The Jan. 26 motion doesn’t mention what the settlement means for the continuation of the SAFE note.

As we revealed last November, the note is a big deal: in the event of any equity financing round or liquidation event, it gives Latona rights to claim at least 53.8%1 of PLS if the company is valued at $65m or above, and more if it’s valued at anything less.

The SAFE note also gives Latona a seat on the board of PLS, for which it had appointed Rheingans-Yoo.

Reis, Mills partner in new trial: REVIVE-TOGETHER

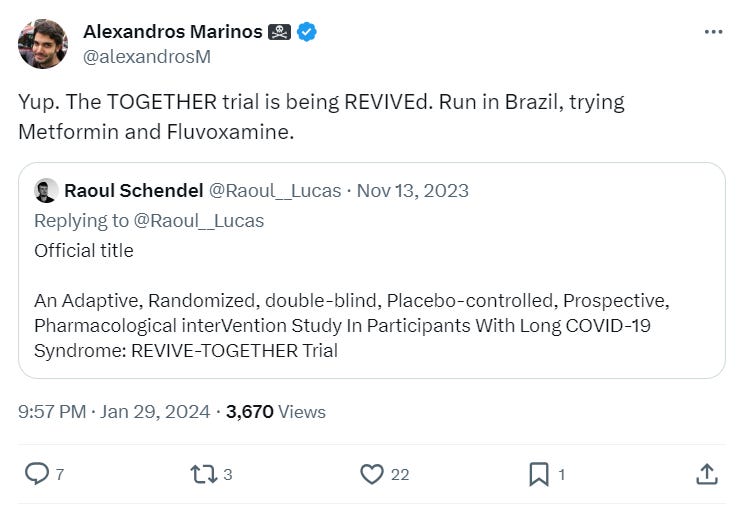

Also interesting is the mention of “ongoing clinical trials”. We had previously reported that we couldn’t find any ongoing clinical trials for TOGETHER. This sentence piqued our curiosity so we searched again, and found that we had missed a trial. Turns out, a new trial did start recruiting last October: the REVIVE trial (NCT06128967).

What does it have to do with TOGETHER, or PLS?

If you scroll down on the Clinical Trials page for the study details, it lists as the official name of the study ‘REVIVE-TOGETHER’: “An Adaptive, Randomized, doublE-blind, Placebo-controlled, Prospective, Pharmacological interVention Study In Participants With Long COVID-19 Syndrome: REVIVE-TOGETHER Trial”.

The entry shows the trial is led by Gilmar Reis of Card Research in Brazil — Reis also worked as co-principal investigator for the past TOGETHER trials.

Our mistake for not finding it sooner — others, such as @Raoul___Lucas on X, had tweeted about it at the time:

There was also a press release last November announcing the trial. The release does not mention TOGETHER, but says the trial was being launched by PLS with Card Research.

The release adds that the trial was designed by researchers at McMaster University in Hamilton, Canada — the university where Mills works as a part time professor. Per the release:

Prominent contract research organization, Purpose Life Sciences (PLS) is set to launch a groundbreaking Phase III clinical trial in conjunction with Dr. Gilmar Reis of Card Research, an expansive medical clinic network based in Brazil. The trial was designed by researchers at McMaster University in Hamilton, Canada, and is aimed at addressing the persisting challenges posed by Long-COVID. As a multi-center study beginning with 1,500 patients, the trial will rigorously assess the efficacy of multiple potential treatment options – beginning with fluvoxamine and metformin – in alleviating the symptoms associated with Long-COVID.

The Clinical Trials entry indicates the study will investigate metformin and fluvoxamine for the treatment of long COVID. It expects to enroll 1,500 participants at several locations in Brazil. Some of the sites have already started recruiting, since Oct. 21 last year.

It is intriguing that neither PLS nor TOGETHER mention the study on their websites. REVIVE-TOGETHER doesn’t seem to have a website, nor a protocol that we could find. Further, neither the press release nor the title of the study in Clinical Trials mention the TOGETHER platform. Considering the accolades TOGETHER had received, one would think its use would be loudly touted.

One possibility is that REVIVE, or REVIVE-TOGETHER, is a new platform trial by PLS. In its investment proposal to Latona in March 2022, which was included in Exhibit 1 of FTX’s legal complaint, PLS mentioned the opportunity to also do research on long COVID-19, among others. It added that it was developing a new study protocol, RELIEF, for the treatment of generalized flu-like symptoms.

Of course, their plans could have changed, and instead of RELIEF, they could have developed REVIVE. We don’t know. To be clear, this is all just speculation.

Here’s the extract from the investment proposal (page 9 in the document):

The TOGETHER Trial was developed as an outpatient platform trial to evaluate candidate therapeutics for the early treatment of COVID-19. We have recognized an opportunity to expand our clinical research consortia to also include the evaluation of candidate therapeutics for prevention of SARS-COV-2, hospitalized patients with serious COVID-19 complications, and patients with long COVID-19 symptoms.

The RELIEF Study protocol is currently in development and will add a second clinical trial protocol to the Platform Life Sciences clinical trial network. This protocol aims to evaluate candidate therapeutics for the treatment of generalized flu-like symptoms that will conduct diagnostics on the patient to determine their cause of illness after they are randomized.

In addition to these two protocols, TOGETHER and RELIEF, that will form the backbone of our network, this strategy will also include developing capacity to accommodate clients who have developed a protocol that may not fit directly into the TOGETHER or RELIEF platform trial structures, such as inpatient or vaccine trials. Finally, to complement TOGETHER and RELIEF as Phase II/III protocols, it is critical that we develop capacity to support clients with Phase I needs. We have initiated conversations with partners in the US and Israel to develop this capacity.

A search in the database of CEP/CONEP — the ethics committees which need to approve all human subject clinical trials in Brazil — lists five submissions for REVIVE-TOGETHER, approved between Aug. 27 last year and Jan. 10, 2024. They are all for the same trial (NCT06128967), with the only difference being different locations and contact details.

Why settle?

As mentioned above, the plaintiffs note that the settlement does not reflect on the merit of their case against PLS. However, they say, the amount of time and resources that they would need to prove their case, including having to pursue legal action in Canada (PLS has filed to dismiss the suit on the grounds of lack of jurisdiction), would make further legal proceedings costly and protracted:

Plaintiffs maintain that they have meritorious claims to recover the full amount of the Transfers. However, Plaintiffs would need to spend significant time and resources proving their claims and obtaining a favorable judgment against PLS Canada, including, potentially, enforcing that judgment abroad. Following completion of jurisdictional discovery, which itself would be costly and consume some of PLS Canada’s remaining funds, PLS Canada may renew its motion to dismiss for lack of personal jurisdiction. If granted, the motion would end the case and require Plaintiffs to file a new lawsuit against PLS Canada in Canada.

Even if Plaintiffs were to succeed in defeating a renewed motion to dismiss for lack of personal jurisdiction, PLS Canada would assert various defenses to the claims, contesting, among other things, Plaintiffs’ assertions with respect to insolvency, the nature and purpose of the transfers to PLS Canada, as well as whether the Plaintiffs received reasonably equivalent value in return.

The fact that former SBF and Rheingans-Yoo are unlikely to be available to testify in part due to ongoing criminal proceedings (in the case of SBF), would further complicate continued litigation and collection of evidence, they write.

Last one to settle

PLS is the last of the life sciences companies sued by FTX to settle.

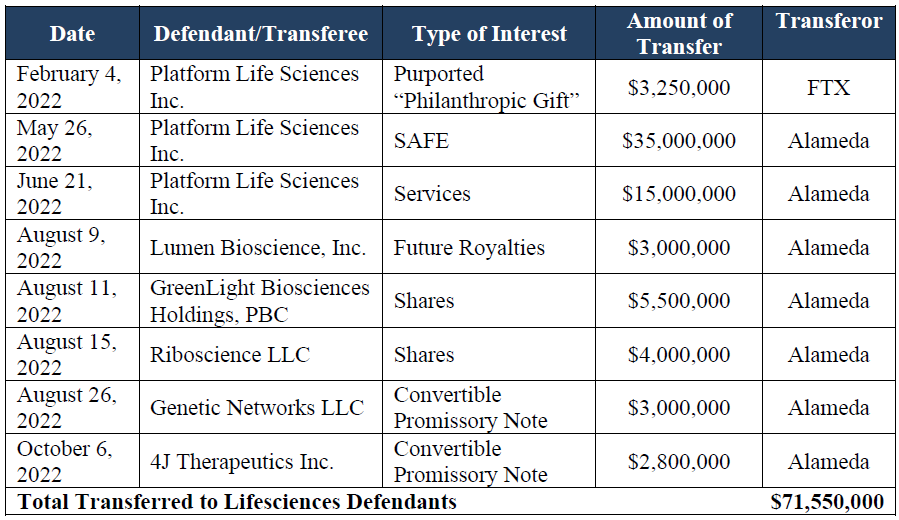

As you may recall, FTX’s administrators sued PLS in July last year along with SBF, associates and five other life sciences companies, in an attempt to claw back funds totaling $71.55 million wired from FTX and its sister company Alameda. The lion share of those funds, $53.25m, went to PLS. FTX’s administrators argue that the transactions were fraudulent, in part as the money came from comingled FTX customer funds.

The five other companies named in the suit already reached a tentative settlement with FTX last fall, leaving Latona, SBF and Rheingans-Yoo as the only remaining active plaintiffs.

Unlike PLS, the smaller life sciences didn’t agree to return funds to FTX, but instead agreed to transfer the rights that Latona Biosciences had acquired over them to FTX (see table).

I should add that even beyond the additional money GAVI received in 2020, Trump personally criticized the WHO but personally lauded GAVI. So even beyond the money aspect, Whitney is entirely correct that Trump removed support from the WHO but expressed support for GAVI. So your position is wrong both in terms of the details and in terms of the bigger picture.

I've followed the GAVI/WHO discussion between you and Whitney on X. Fact is: in 2020 US reduced WHO funding but announced increased 4-year GAVI funding plus additional GAVI COVAX money. So Whitney is correct. Was this money "redirected"? Redirection can mean ex-ante deliberate redirection or ex-post de facto redirection. The latter is certain, the former is possible. Overall, this appears to have been a failed straw man attack against Whitney in the context of your long-standing feud over the role of Musk/Thiel.